loveland co sales tax license

You will need to provide your Larimer County or State sales tax number your name and phone number name of. Single Special Event License.

Free Donation Receipt Donation Request Form Donation Form Donation Request

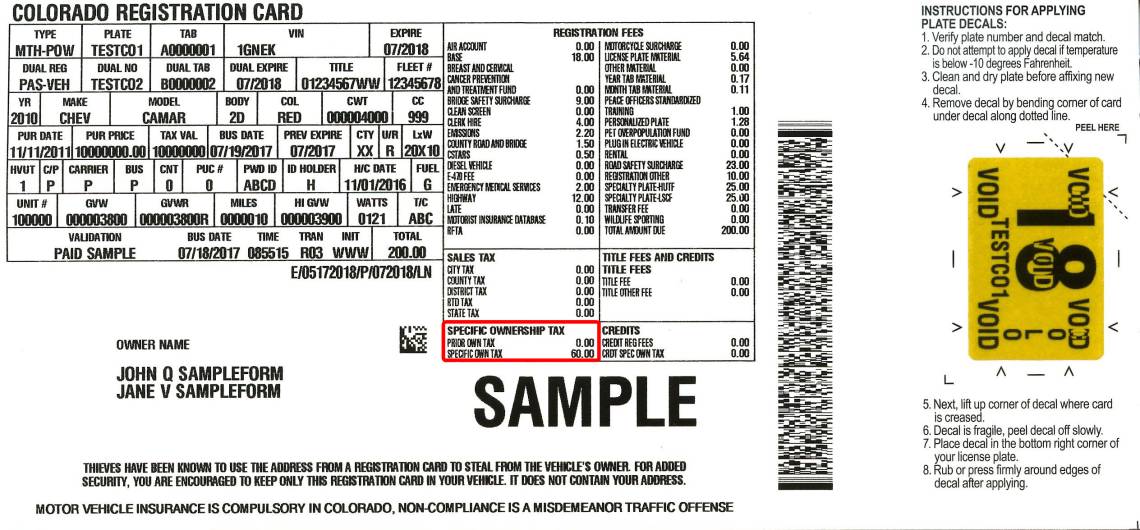

This tool is designed for calculating the sales tax rates for residents of Larimer County who purchased a motor vehicle on or after January 1st 2019.

. License Number 15092. To view Building Permits click Public Access from the choices on the left no login credentials needed For Sales Tax please provide email login and password. 670 Sales Tax Chart.

Ad New State Sales Tax Registration. 80537 80538 and 80539. License Valid 112021-12312021 Business Location.

Renewed licenses will be valid for a two-year period that. Find out with a business license compliance package or upgrade for professional help. In all likelihood the Colorado Sales Tax Withholding Account Application - CR 0100 AP is not the only document you should review as you seek business license compliance in Loveland CO.

At LicenseSuite we offer affordable Loveland Colorado sales tax permit compliance solutions that include a comprehensive overview of your licensing requirements. An alternative sales tax rate of 77 applies in the tax region Berthoud. Sale Tax License information registration support.

At LicenseSuite we offer affordable Larimer County Colorado sales tax permit compliance solutions that include a comprehensive overview of your licensing requirements. How to get business licenses in Loveland CO - Get everything a business owner needs in one DIY package or upgrade for professional help. The Colorado Department of Revenues Sales and Use Tax Simplification SUTS Lookup Tool is available to lookup municipality and delivery address sale tax rates.

Avalara can help you automate the business license application process. Do you need to submit a Tax Registration in Loveland CO. This empowers you to.

Before you apply for a sales tax license or submit your first payment please contact your bank and provide them with the City of Lovelands ACH DebitAccess ID 8846000609 to ensure your. Standard Municipal Home Rule Affidavit of Exempt Sale. Ad New State Sales Tax Registration.

The amount due is a percentage of the purchase price and is based on the taxing. Ad Simplify the sales tax registration process with help from Avalara. Sales taxes are due one time after a new or used vehicle purchase at the time your vehicle is titled.

The City of Loveland is a home rule city and began administrating and collecting its own sales tax in 1999. The easiest way to change an address is to call the office at 970 498-5930. For a temporary location other than your regular business location and.

The Colorado sales tax rate is currently 29. If the licenses is needed immediately a fee of 500 will be charged. The minimum combined 2022 sales tax rate for Loveland Colorado is 67.

There is no fee for a new license will be mailed to the business during the time new applications are processed. Free viewers are required for some of the attached. OCCUPATIONAL TAX The State of Colorado gives the City of Loveland the authority to tax the business of selling alcoholic beverages.

11700 PRESTON RD 660153 DALLAS TX 75230 THIS CERTIFIES THAT. General Information A sales tax license shall be required for any person who is. Sales Tax License Renewal Form.

Sale Tax License information registration support. City of Loveland Sales Tax License. This is the total of state county and city sales tax rates.

Sales Tax License Application. The sales tax license enables the business to collect sales tax when they resell the items. This Occupational Tax is assessed and is due yearly.

The Loveland Colorado sales tax rate of 67 applies to the following three zip codes. All Sales Tax collected is paid to the Colorado Department of Revenue on a monthly quarterly or annual payment depending on the businesss revenue and will be remitted to the Town of. Visit Where can I get vaccinated or call 1-877-COVAXCO 1-877-268-2926 for vaccine information.

A sales tax license is required in order to collect and remit sales tax that is collected by the Colorado Department of Revenue. Youll likely need a business license to open a cafe or restaurant in Loveland. 500 East Third St STE 110.

Avalara can help you automate the business license application process. Ad Simplify the sales tax registration process with help from Avalara. This is in addition to any other local or state licenses that may be required in Loveland.

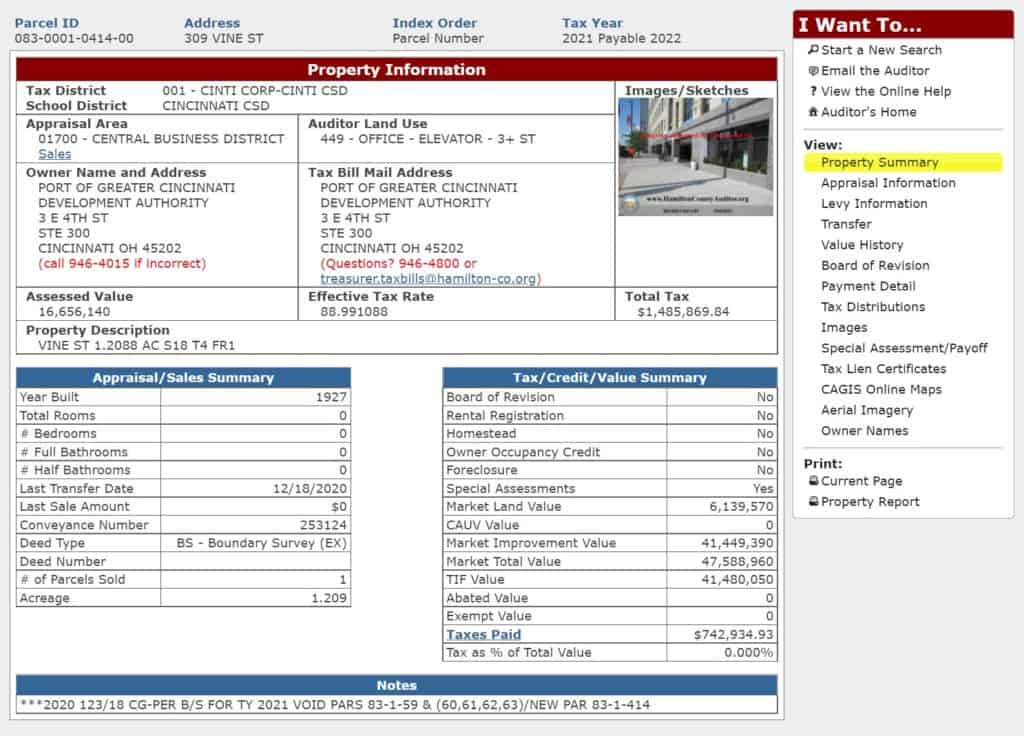

Hamilton County Ohio Property Tax 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Business Sales Use Tax License Littleton Co

Where To File Sales Taxes For Colorado Home Rule Jurisdictions Taxjar

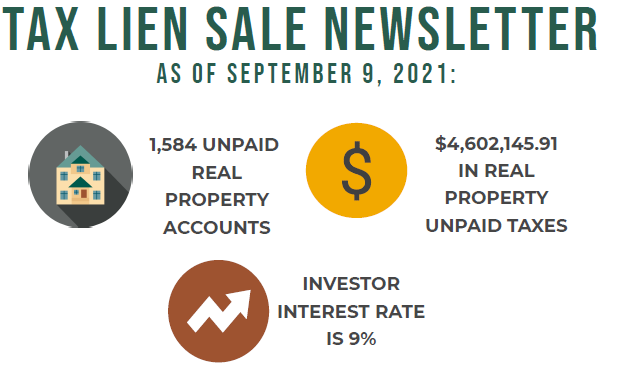

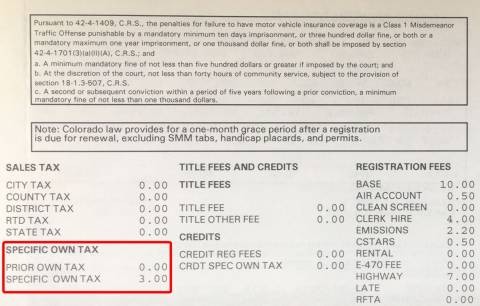

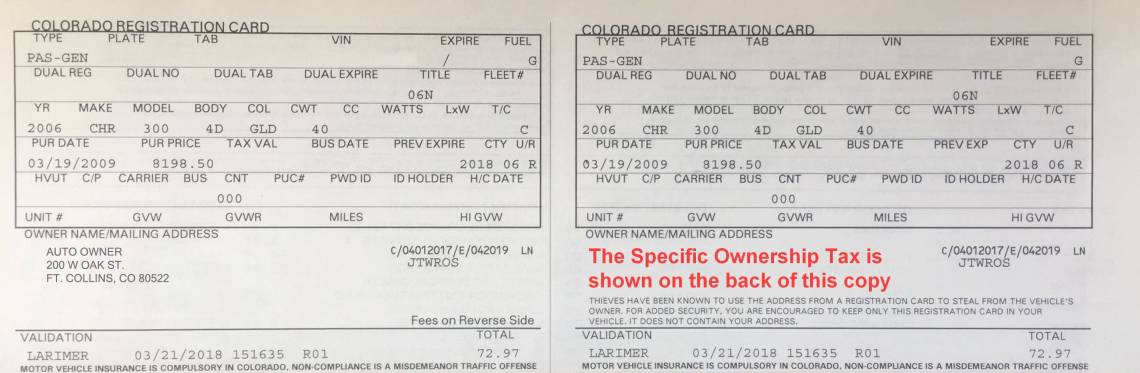

Specific Ownership Tax Larimer County

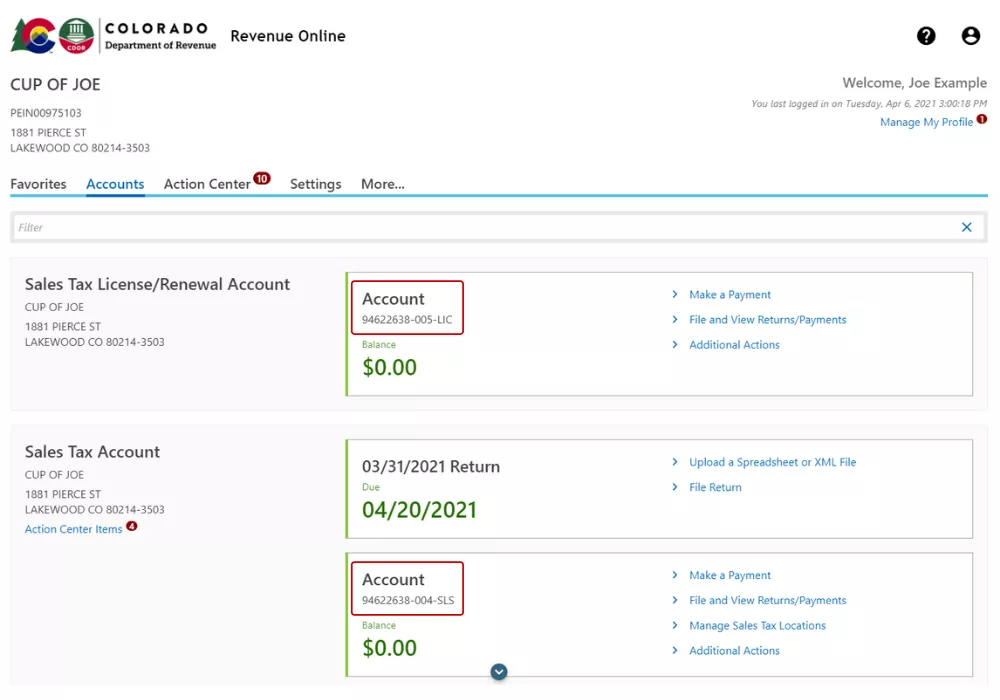

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Eat Where You Shop And Post All About It Wwd

Renew Your Sales Tax License Department Of Revenue Taxation

Specific Ownership Tax Larimer County

States Are Imposing A Netflix And Spotify Tax To Raise Money

The Pass Through Of A Tax On Sugar Sweetened Beverages In Boulder Colorado Cawley 2021 American Journal Of Agricultural Economics Wiley Online Library

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Customer Service 101 A Guide To Providing Stand Out Support Experiences Small Business Management Business Major Business School

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Co Dept Of Revenue Co Revenue Twitter